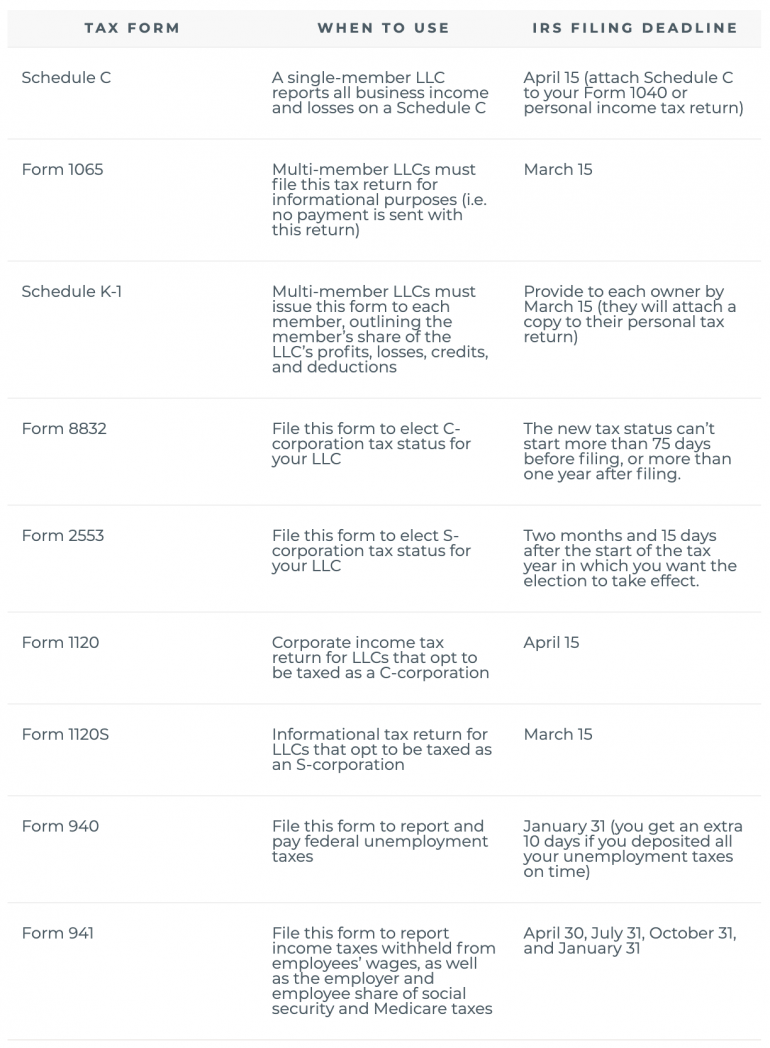

Most practitioners (80%) are fortunate to not have been involved in any client disputes during the last year. Sixty-two percent charge for IRS audit response letters when the return was prepared by another party 47.5% charge when they are not at fault for a return they prepared and 10.3% always charge or an IRS response letter. Only 8.8% of preparers never charge for an audit response letter. The average hourly fee for an in-person IRS audit is $150 and the average fee for an IRS audit response letter is $128. The majority of those surveyed (58.3%) have not seen any change in the number of audits. * $57 for a Shared Responsibility Payment Calculation * $58 for a Form 1095‐A (health insurance marketplace statement) * $53 for a Form 8965 (health coverage exemptions) * $59 for a Form 8962 (premium tax credit calculation) * $282 for a Form 3115 (application for change in accounting method) * $532 for a Form 5500 (pension/profit-sharing plans) * $242 for a Form 8824 (like-kind exchanges) * $69 for a Form 940 (federal unemployment) * $184 for a Form 1040 Schedule C (business) * $176 for a Form 1040 (non-itemized) and a state return * $273 for a Form 1040 with a Schedule A and state return * QuickBooks or Bookkeeping Advisory Services – $97 * Financial Statement Presentation – $134 Another 33% charge an additional fee for file extensions, 22% charge an additional fee for information received after a set deadline, and 24% charge an additional fee to expedite returns.Īverage hourly fees for various client services include: Nearly three quarters (71%) charge an added fee for disorganized or incomplete files. Surveyed firms expected to increase tax-prep fees by an average of 6.4% in 2017, up from an actual increase of 6.0% in 2016. Tax-preparation fees were expected to rise by higher percentages. Surveyed firms expected to increase their accounting service fees by an average of 6.1% in 2017, up from an actual increase of 5.3% in 2016.

For accounting fees, 37.4% increase fees annually, while 34.4% increase fees every other year. Nearly half (49.8%) of tax and accounting practices increase tax preparation fees annually while 33.7% increase these fees every other year. The average fee charged to prepare an itemized Form 1040 with Schedule A and a state tax return is $273, and the cost for a Form 1040 without itemized deductions and a state return is $176. Most bill for tax preparation by form (39.5%), hourly (8.4%), by a combination of fixed and hourly fees (25.0%) or by fixed fee only (23.2%). Firms split fairly evenly regarding billing methods for accounting services, with about a third billing by fixed fee (35.3%), hourly (31.2%) or a combination of the two (31.8%).

0 kommentar(er)

0 kommentar(er)